Lackawanna County appears headed for another property tax increase in 2025 to solve its major financial problems and balance its budget, a bond rating agency says in a new analysis.

In the June 3 analysis, S&P Global Ratings suggests the county acknowledged the necessity of a tax hike, though the ratings report doesn’t specify the possible size. The analysis accompanies the rating agency’s second downgrade of the county’s bond rating in eight months — from BBB+ to BBB.

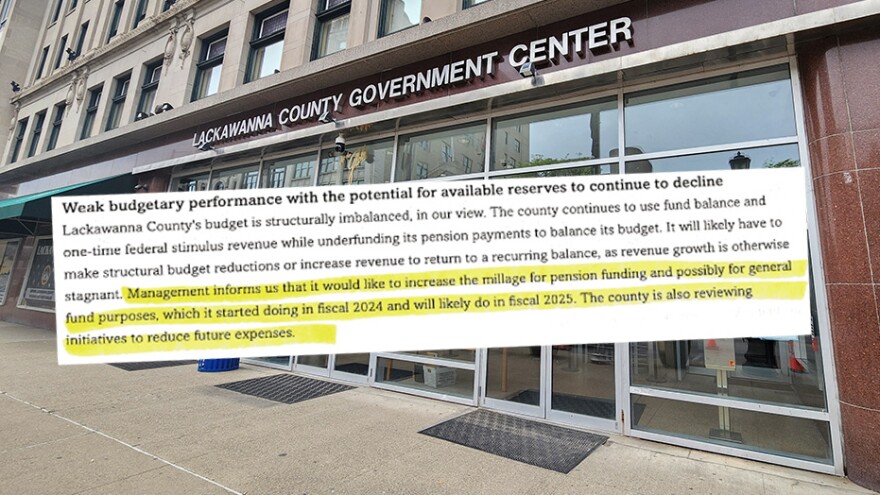

“Management informs us that it would like to increase the millage for pension funding and possibly for general fund purposes, which it started doing in 2024 and will likely do in 2025. The county is also reviewing initiatives to reduce future expenses,” S&P primary credit analyst Michael J. Mooney wrote in a bond outlook.

After a commissioners meeting Tuesday, Commissioner Bill Gaughan said it’s way too early to predict a 2025 tax hike but did not dispute the possibility.

“Anyone who looks at the financial condition of Lackawanna County right now would be hard-pressed to say that taxes are not going to go up in this next budget,” he said. “How much they're going to go up, I don't know.”

Commissioner Chris Chermak portrayed a tax hike as inevitable.

“I still don't see any way around a major, major tax increase, which, again, as I say at every meeting, I'm not going to support that until we look at major, major cost cutting initiatives and cost savings,” Chermak said during the meeting.

Not the first downgrade

The latest downgrade arrived as the county prepares to borrow $12.28 million, partly to fix a $5.5 million gap in its 2024 budgets. The downgrade will mean the borrowing could carry a 0.25 percentage point higher interest rate, but it might not be that high because the debt will be insured, county Chief Financial Officer David Bulzoni said.

That could mean higher annual debt payments through 2035. The amount was not immediately available. Bulzoni said the lower rating remains “investment grade,” which means it should attract investors.

The downgrade also covers the county’s existing debt. After the new borrowing, the county will owe about $210 million, S&P estimates.

S&P blamed the downgrade on shaky finances that grew out of past financial mismanagement. The mismanagement included over reliance on one-time revenues sources; a structural budget imbalance with expenses chronically exceeding revenues; a refusal to properly fund the county pension plan; and the lack of a long-term financial plan.

Lots of unpaid bills

The county entered 2024 with $19 million in unpaid bills, despite S&P saying an audit showing the county ended 2022 with a $15.7 million budget surplus.

In November, county commissioners Debi Domenick and Jerry Notarianni voted to increase property taxes by 3.75 mills to 67.67 mills.

For someone who owns a property valued at $10,000, that meant an increase of $37.50 in taxes to $676.70. The amount does not include borough, city, township or school district taxes.

Chermak voted no, citing the over reliance on one-time revenues sources and the county’s failure to seek spending cuts and control expenses.

The one-time revenues included $3 million in federal American Rescue Plan Act money, $2.33 million in unused health care plan money; $1.22 million from increased revenues in some categories and 262 line-item spending cuts; and $5.5 million from the upcoming borrowing.

One-time revenue means money that won’t be available in future years.

After the commissioners meeting Tuesday, Commissioner Bill Gaughan, who, with Commissioner Matt McGloin, took office in January, blamed the past commissioners for the mess.

“It was mismanaged to be brutally honest,” Gaughan said. “What I've seen since I've been here in January, a lot of it doesn't quite make that much sense.”

Notarianni said he was surprised Gaughan blamed him and Domenick for the financial problems because Gaughan knew the county's financial condition as he ran for office.

"It's a difficult situation," he said. "We started to do things to address it, but we ran out of time."

He pointed to his and Domenick's decision to reassess county real estate for the first time in more than 50 years, which should help the county's finances eventually.

"They're doing nothing but hiring people," Notarianni said. "There's more people on the sixth floor than ever before."

The commissioners' offices are on the sixth floor of the county Government Center.

Domenick declined to comment.

Borrowing a must

Gaughan said the borrowing is necessary if unappealing because the $5.5 million is in the 2024 budget.

“There was no other option at this point, at least that I could see,” Gaughan said. “For us to say, no, we don't want to do that, well, that's great. Where are you going to come up with $5.5 million?”

The rest of the borrowing will pay for $4 million in fixing roads, bridges, courthouse renovations and a new prison roof and creating a single-point paying agent program.

The commissioners voted Tuesday to create the program as part of the county’s efforts to improve its credit rating.

Under the program, the county will dedicate a specific millage rate to paying off borrowing, and tax bills will reflect that millage. Any money collected from that millage will go from the county treasurer’s office to a trustee, separate from the bank that holds the county’s tax collections. That trustee will then forward the money to pay off debt. The trustee essentially works for the investors who bought the county notes or bonds and must use the county tax dollars to pay them.

Rescuing the county

Gaughan counted that among other measures the commissioners have taken to get the budget under control since taking office. Others include hiring PFM Consulting Group in April for $276,800 to develop a financial plan for getting through 2024 and another for the next five years; hiring ClearGov in May for 3 1/2 years for $61,990.77 to develop a user-friendly, digital budget designed to more clearly explain county spending and revenues to taxpayers; and buying a priority-based budgeting system.

The commissioners hired Tyler Technologies at $100,000 a year to provide the priority-based budgeting software, which is supposed to have more detail on spending and revenues. Tyler predicts the software will lead to significant savings.

During the meeting, Chermak, who served with Domenick and Notarianni, lamented the programs’ costs.

“Every time we implement something, there's a major cost to it,” Chermak said. “My hope is that when these reports come, once we get the answers to some of these questions, that there's going to be some ability for the county to save money. But we’re in month six already and we haven't saved a penny since we walked in this door.”

Gaughan called Chermak’s statement on the lack of savings “completely false.”

He pointed to the commissioners’ recent decision to abandon plans for a county department of health and reallocate its unused staff to other duties.

“And in effect, we're going to save a few million dollars a year on that effort,” he said.

McGloin pointed to Chermak’s presence as a commissioner when Notarianni and Domenick controlled county government, even noting Chermak’s vote against the 2024 tax hike.

Turning to Bulzoni, McGloin asked, “Dave, am I wrong when I say if you continue down that path, it is not sustainable to continue to operate that way?"

“That would be a correct statement,” Bulzoni replied.

The new borrowing prompted the latest bond rating, but the commissioners issued a statement calling the downgrade “surprising.” Little about the county’s financial condition changed since the last downgrade, the statement said, but it noted the steps Gaughan outlined to improve finances.

Note: This story was updated Wednesday, June 19, 2024, to add comments from former Lackawanna County Commissioner Jerry Notarianni.